Money Trees

Occasionally, you come across business ideas that can create cash out of thin air. Ideas so good they may as well be money trees.

One that I find is discussed in certain circles, but not deeply thought about by most, is the gift card. At its core, it's pretty simple. I give a company $10, they give me a card that lets me redeem that $10 worth of their product whenever I want. It's an IOU, fair and square. Right?

Not really. If you look at gift cards at the highest level, yes, they are just IOUs (another word for debt). This is a really important concept to understand as a gift card consumer. You have debt on your car, house, student loans, and it's understood: The bank gives you money upfront so you can buy a car. For taking the risk of giving out money upfront, the bank charges you a fee. That fee is called interest, and it's what you pay the bank in exchange for their service of giving you money.

Gift cards are the same, but different.

Gift Cards & Interest Rates

I'll use Starbucks as an example in this post, but this really applies to any company that has a strong gift card program. Starbucks is top of mind because we're nearing the holidays, and I've just done my annual re-read of the infamous Moneyness article on Starbucks.

Let's say I go to Starbucks and give them $10 in exchange for a $10 gift card. What I've just done is given Starbucks a loan of $10, in exchange for them giving me $10 of coffee later. That's the deal, and it isn't a good one. I have turned myself into the bank by lending Starbucks my money, but I don't get to charge them any interest. Not great for me. For Starbucks (and every other firm with gift cards), it's brilliant.

But what could be more brilliant than a company opening a funding avenue at 0% interest from their own customers? Well, a few things.

Breakage

You know when you get to the end of a gift card, and it has like $0.50 left on it and sits in your center console for a year? Or when you leave it in your pocket and accidentally run it through the wash? That's called breakage, and Starbucks loves it. Breakage is the money on gift cards that gets left unspent. And it's a lot. Starbucks, for example, writes off ~10% of their outstanding gift card balances every year as breakage. Of their staggering $1.6B in outstanding gift cards, that's $160M annually in IOUs that Starbucks doesn't expect to honor.

Here's what that means in real life: I lend Starbucks $10, I only spend $9 of it and then I lose my gift card. I just gave them a 0% interest loan with my $10, and then said it's fine if they only pay me back $9. So Starbucks actually has a better than 0% interest rate on their gift cards - a $10 gift card is worth more than $10 to Starbucks. It's called a negative interest rate loan, my friends, and you want to be on the borrowing end of it.

When factoring in breakage, Starbucks has built a true net-negative interest rate borrowing environment through its customers, all in the form of gift cards. Brilliant.

Paying with Product

The shining gem that gets overlooked in most discussions about gift cards is not the 0% interest loan, which a lot of folks understand, but the fact that companies don't pay back the debt (gift card) with cash. They pay with product.

This tilts the financial engineering even further in Starbucks' favor. Think about it. A loan from a bank (or anywhere else) gets paid back with cash. Gift cards are paid with product.

When I redeem my $10 gift card at Starbucks, they aren't selling me $10 of coffee at cost. They are selling me $10 of coffee with a markup (which they pocket). If we assume Starbucks has around a 30% margin, that means the total cost to them of my $10 coffee is $7. They keep $3.

So in return for my loan of $10, they pay me back a net $7 after they take their share.

This is on top of the 0% interest, breakage that will never be redeemed, and the brand value they get in having a popular gift card program. Pretty good gig.

Float

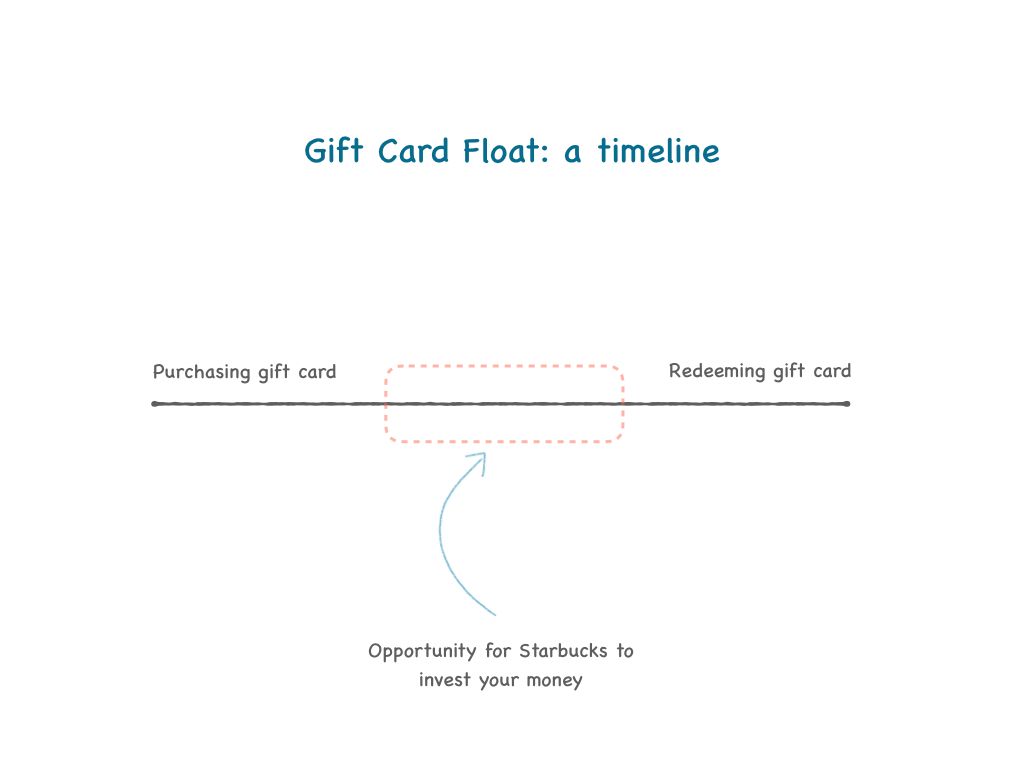

The finance nerd in me needs to take this yet another step further and talk about float. Float is the time between when you write a check and the recipient cashes it. It's money that is owed, and will be paid, but hasn't been yet. It's an opportunity to generate return before you lose the money for good.

In our Starbucks example, I'll call float the time between when a gift card is purchased and when it is used. That leaves an insane amount of cash for Starbucks to use to its advantage before gift cards get redeemed. Savvy capital allocators would generally use float to expand operations or invest into the business some other way. These are usually the right thing to do, but for this example it's hard to pin down the quantified returns that would generate. So instead, let's just assume Starbucks invests in short term treasuries.

Starbucks' outstanding gift card balances are about $1.6B. If they were to take some portion, say 1/4, of that $1.6B and invest in 30 day t-bills at 0.08%, the return would be $3.2M. That's $3.2M created out of thin-air. Millions of dollars created with consumer gift card purchases not yet redeemed, at a net-negative interest rate, all without Starbucks investing their own money.

Money Trees.